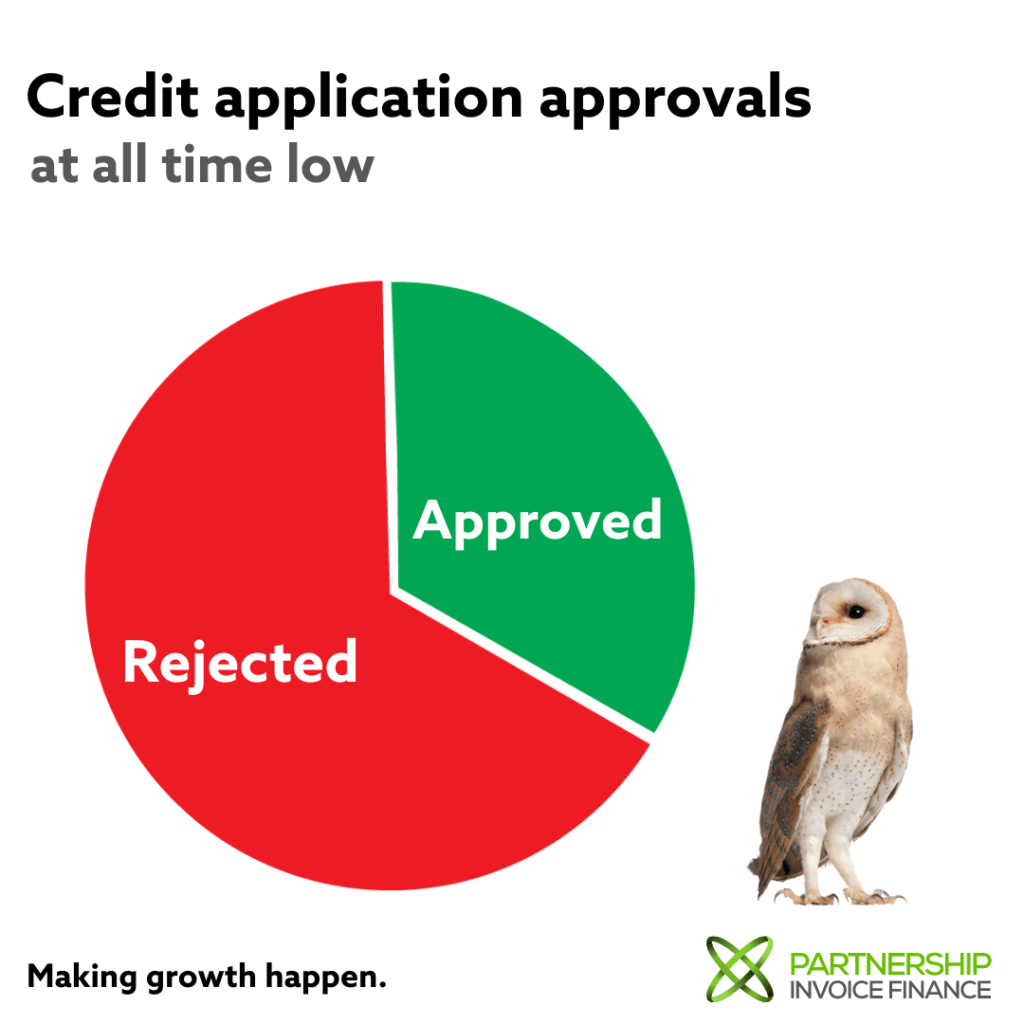

Credit and Loan Application Approvals at an All-Time Low for Small Businesses

Small businesses are the backbone of the UK economy, and yet credit and loan approvals are at an all-time low which is having a significant impact on small businesses, which are struggling to expand and grow.

In this article, we’ll take a look at what credit and loan providers are looking for in order to approve an application and what other options are available. We’ll also discuss why small businesses are being rejected for credit approvals more than ever before.

Why are small businesses being rejected for additional finance?

The credit crunch, Brexit and the global pandemic have hit small businesses hard. With banks and other financial institutions tightening their lending criteria, it has become increasingly difficult for small businesses to get credit and loan applications approved, reaching an all-time low in credit and loan application approvals.

One of the main reasons credit and loan providers are rejecting small business applications is because of the current economic climate. This is leading to an increase in bad debt, and weakening the balance sheet for many businesses. This leaves them cash poor as they struggle to meet demand for their goods and services.

This in turn can lead to businesses being rejected for credit because of their credit score. Generally, in order to get approved for a loan from a high street lender, businesses need to have a good credit score. Generally, in order to get approved for a loan from a high street lender, businesses need to have a good credit score. Providers use this as an indicator of how likely the business is to repay the loan. If a business has a low credit score, it means that they are more likely to struggle which in turn will lead to a potential default on the loan.

So, what are credit and loan providers looking for when assessing applications? Here are some of the key factors that they will take into account:

The creditworthiness of the business: This is one of the most important factors that lenders will look at. They want to see evidence that the business is financially stable and has a good credit history with profits made and retained within the business.

The amount of money being requested: Lenders not only look at whether the advance is too large or too small but will also consider that the amount of money that the business is requesting is in line with its ability to repay and the impact of further rises in interest rates. They will only approve loans if they feel that the business will be able to generate sufficient cash to keep up with repayments.

The purpose of the loan: Lenders will want to know what the loan is for and how it will be used. They need to be satisfied that the loan is being used for a legitimate purpose and for the overall benefit of the business.

The security available: Lenders will also assess whether security is required and what security is available to them. This could include property, plant & machinery, or even personal assets. They need to be satisfied that they will be able to recover their money if the business fails to repay the loan.

In order to get approved for credit or a loan, businesses need to show that they are financially stable and have a solid plan in place. This includes having up-to-date financial statements, as well as ideally a detailed business plan. Any small dink in the required criteria or financial stability of the business and the credit or loan application is likely to be rejected.

What other options do small businesses have to secure funding?

With traditional credit and loan application approvals at an all-time low, small businesses are now becoming aware of other finance options in order to secure funding. One such option is invoice finance. Many small businesses are now using the services of an accredited funder and using invoice finance as a safe and stable way of growing their business, combating late payments, and achieving a healthy cash flow.

Entering into an invoice finance agreement is also often a much shorter and simpler process than jumping through all the hoops of trying to obtain finance or credit through more traditional means such as banks.

There are many benefits of invoice finance for small businesses, including the fact that it is a flexible funding option which can be tailored to the specific needs of the business and secured on its debtor book. Invoice finance helps businesses to combat late or slow payments, by providing them with an advance on their outstanding invoices. This frees up much-needed cash flow and helps businesses to grow and expand.

If you are a small business owner who is struggling to secure credit or a loan, then invoice finance could be the perfect solution for you. Contact us today for more information on invoice finance and how we can help your business to succeed