Invoice Finance; Did You Know?

As a small business owner, you’re always looking for ways to improve your bottom line, but did you know that invoice finance could be one of the smartest moves you could make? Many business owners are surprised by the facts and figures associated with invoice finance. How Popular is Invoice Finance? Invoice finance is actually […]

How Invoice Finance Benefits Companies in the Courier and Haulage Industry

Running a courier or haulage company can be tough. You’re always on the go, making sure that your client’s goods are delivered on time and in perfect condition. But even the most reliable and established companies can experience cash flow problems. Every business owner knows that cash flow is essential for keeping your business afloat. […]

Invoice Finance – Providing A Steady Recovery Amidst Economic Uncertainty

In the midst of economic uncertainty, invoice finance has been a steady and reliable source of funding for businesses. In recent months, we have seen an uptick in the number of SMEs using invoice finance to get the money they need to grow their business, as, despite the very real pressures on finances, many are […]

Essential Financial Guidance for Small Businesses

Running a small business is hard work, but it can be incredibly rewarding. However, one of the main reasons why small businesses fail is due to a failure to understand financial management. In this blog post, we are going to look at financial guidance for small businesses. We will discuss cash flow, accounting, taxes, planning […]

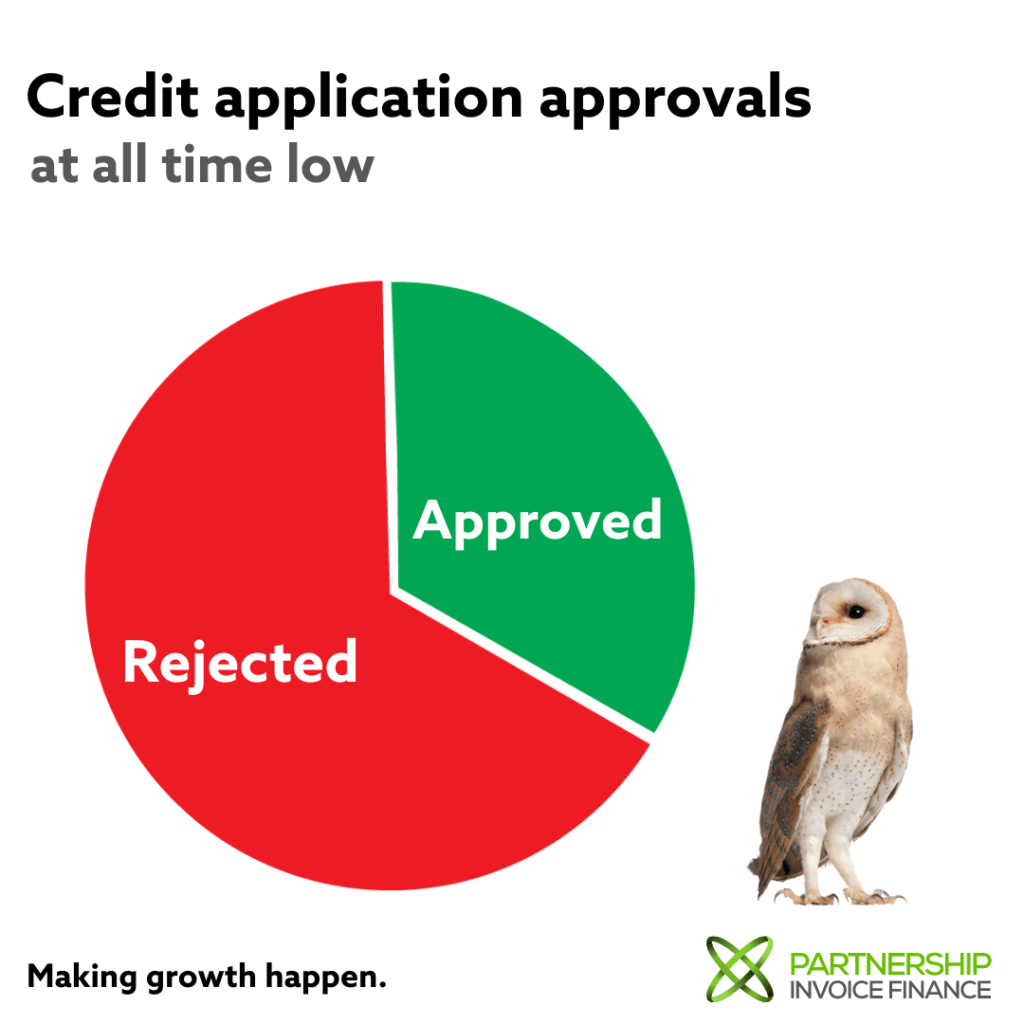

Credit and Loan Application Approvals at an All-Time Low for Small Businesses

Small businesses are the backbone of the UK economy, and yet credit and loan approvals are at an all-time low which is having a significant impact on small businesses, which are struggling to expand and grow. In this article, we’ll take a look at what credit and loan providers are looking for in order to […]

The Effects of Rising Costs on Small Businesses

It’s no secret that small businesses are struggling to survive in today’s economy. With constant rising costs and inflation at an all-time high, it has become increasingly difficult for business owners to keep their heads above water, add in the value of the pound dropping significantly and import prices increasing, it’s a tough environment to […]

Late Payments Are Taking a Toll on Small Businesses: What’s the Solution?

It’s no secret that late payments are still having a significant impact on small businesses and the number of small businesses being impacted by late payments is increasing. This is causing many small businesses to struggle, as they become unable to maintain their cash flow and operations. Late payments also have a knock-on effect on […]

Small Business Funding Options When the Banks Say No!

Small business owners often find it difficult to secure traditional finance and funding from banks and other lenders, and with many of them tightening their lending criteria and government covid support ending, it’s leaving small businesses feeling stuck and with no way to grow their business. Why are Traditional Lenders Shunning Small Businesses? One of […]

Getting Started with Invoice Finance

Invoice finance is an excellent source of finance for small to medium businesses that are looking to stabilise their cash flow and grow their company. Invoice finance can be used to cover a wide range of expenses including, but not limited to, expansion, hiring new staff, marketing campaigns, and purchasing new equipment or stock. Unfortunately, […]

How Small Businesses Can Better Manage Debt with Invoice Finance

If you’re a small business owner, then you know that managing debt is a daunting task. Every day it seems like there’s another bill to pay and another interest rate to worry about. This can be especially difficult when your business is just starting out and you don’t have the profits readily available to cover […]